Inflation – the third certainty of life

Death and taxes are said to be the only certainties of life, but I’d like to add a third: price inflation. In a healthy economy inflation is apparently viewed as a desirable thing, so long as it remains reasonable steady and at a low rate. To me this feels a bit like saying keeping a pet dragon is great, at least until it wakes up feeling hungry.

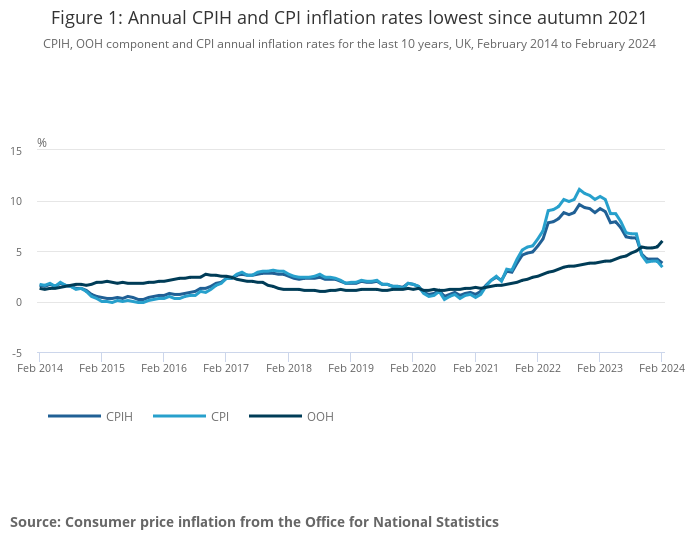

The UK government aims to keep inflation at around 2%. As you can see from the above graph, from 1993 to the start of 2021, things seemed (at least in retrospect) to be under control. Since 2021, along with much of the world, inflation in the UK has risen to levels not seen in decades, peaking at almost 10% in October 2022. For pretty well everyone, this has affected almost every aspect of day to day life.

The antiques business is not immune from the effects of inflation and it often seems like it suffers from all of the negative effects but is unable to get any benefit from rising prices.

Inflation and antiques over the long term

If you watch antiques programs on television you’ll be familiar with members of the public getting exciting sounding valuations from experts for items bought for much less, many years previously. On first glance this sounds like you just have to be patient to make money, but when you look at the effect of inflation a different story comes out. Let me explain (and do the maths)…

When you allow for inflation, an item bought in the UK for £100 in 1960 should be worth about £3000 today. So someone being told a necklace bought for £50 in 1960 is worth between £1000 and £1200 has probably made a loss on it, especially when you factor in selling fees. Hopefully you have had the immeasurable pleasure of ownership in that time, but as an investment it was probably a bad move.

My example there does however imply that antiques, in general, do rise in value over time – especially items that have some intrinsic value such as gold, silver or precious gems. Fashions and trends in antiques and collecting do, of course, have a big impact as well. At some stage I’ll get round to writing about this as it’s a big, and fascinating, subject.

Some effects of the recent spike in inflation on the antiques business

The recent spike in inflation has had a number of dramatic effects on the antiques business, not least because it happened so quickly. Some of these are fairly general and obvious, some less so as they reflect the unusual nature of how and where people buy and sell antiques.

Bargains to be had

Antiques can have a very long shelf life. Far longer than most businesses could accept, simply because the items are meant to be old when they arrive for sale.

Few, if any, dealers would have the confidence to increase the price on an item that has gone unsold since 2021. More likely they might consider a price reduction. When you factor in inflation even at on an unchanged price you’re getting about a 20% discount compared to the day it was priced up.

Antiques often sit in shops for a couple of years (or a lot more) which you can usually spot from the telltale signs of accumulated dust and a faded ticket. I know of a painting of a tiger which I like that has been in the same place, at the same price, since we bought a sister painting of it about 6 years ago. It’s a bargain now, being about 30% cheaper in real terms.

Increases in costs

The antiques business is not immune from the effects of inflation that are common to almost all businesses. Energy costs are usually the first thing to be noticed when prices rise. Traders tend to travel a lot, usually by car but often with vans. This makes them very sensitive to the price of fuel.

Recently a trader friend of mine explained to me the effect of inflation on vehicle leasing costs. He has leased a van for the last three years but that is coming to an end. The like for like replacement is around 60% more expensive. He reckoned he simply can’t afford that so he will have to look for an old van that he can keep on the road. It’s not a prospect he relishes as old vans are notorious for breaking down.

As rents and commercial rates have risen, shop owners with traders renting space look for ways to cover their increased costs. There are usually two elements to this: space rental and house sales’ commission. Rents generally rise each year and dealers expect although welcome it. House sales’ commission is the amount levied on any sale made through the shop and usually around 5 to 10%. This generally doesn’t change year on year but there has been a trend towards increasing it this year. Since traders rarely increase prices on items once they arrive in a shop any increase in the house sales commission simply takes an additional slice of the trader’s profits.

So far, I’m pleased to see that pitches at fairs and shows don’t seem to have gone up very much. There have been a few increases but organisers realise that if the prices rise very much then traders will stay away. I know from recent experience that trade volumes are very much down at fairs and a number of fairs may become unviable in the coming year or two.

Auction House Buyers Premium – The biggest increase of all

As I explained in a previous posting, every auction house charges buyers a premium on each item purchased. This is almost always a percentage of the hammer price, plus VAT. In the last couple of years buyers premium has risen really dramatically.

On the face of it, it’s probably just a reflection of the increases in costs that auction houses (like any other business) have to face. However, I think there’s more to it.

Much, if not most, auction bidding is now done online. In the UK this is generally through one of three platforms:

- The Saleroom

- Easylive

- An auction house’s own bidding platform

(Note that in all the following, I’m including VAT as most people have to pay that)

Of these three platforms The Saleroom has always been the most expensive. Currently their usual fee is now 5.94% of the hammer price

Easylive charges 3.6% of the hammer price or you can pay a flat fee of £3.00 per auction and have no additional charges

An auction house’s own bidding platform is usually free to use, but be careful. I see that Fieldings Auctions are now charging 2.4% to use their platform. I love Fieldings auctions (and am a frequent customer) but this is a very unwelcome development that I hope doesn’t spread.

So, at the time of writing, the Easylive flat fee per auction of £3.00 is an absolute bargain. This even works for bidding on Fieldings auctions so Easylive is generally cheaper than Fieldings own platform. If I was going to make a prediction, the flat fee option will increase sooner rather than later.

Remember that online charges are in addition to the auction house buyers premium. The buyers premiums now seem to range from 10% (a special mention here for David Hancock Auctions, an old fashioned, in-room only, shout your name out if you’re the winning bidder type of auction) to the likes of Potteries Auction who charge 30%.

And the winner(?) is…

The most extreme case I can see is if you bid on The Saleroom (5.96%) at Potteries Auction(30%) and pay then by PayPal (a further 5%). You would then be paying a total of 40.96% buyers premium. You can see why I like David Hancock Auction!

I was told by an auction porter this month that a dealer that used to buy frequently from them has regretfully given up using that auction because of their fees. I still use that auction but any bid I make is adjusted for the additional charges and as a result I’m bidding to a lower limit.

The effects of inflation on buyers

Buyers of art and antiques are of course affected by inflation. The effect here is much harder to see though. Every dealer and trader will have their own story, each of which is as valid as mine, so I’ll keep this part short. From my own recent experience I would that the three most obvious things are:

- Overseas buyers of smaller items for personal pleasure are simply not visiting the UK in the numbers they were doing, so the selling price of items makes no difference to them as they just aren’t here.

- Domestic buyers of smaller items are simply not spending very much at all. This is hardly surprising since art and antiques are luxury items an increasing number of people can’t consider.

- Collectors of higher value items are still buying, almost unaffected. By higher value here I mean items close to maybe £100 and above. There’s no doubt that for the popular type of item there are still plenty of people willing to fight it out at auction or indeed walk into an antiques shop and make a purchase. If you’re not sure about this try buying a piece of Troika pottery or an item Robert Thompson furniture (the stuff with a mouse on it) cheaply!

This last point in particular is probably true of society as a whole: inflation affects different people very differently. Along with everyone else, I’m hoping that as inflation falls, everyone starts to benefit.